A penalty of AED 10,000 will be imposed on companies that fail to register for corporate tax on time.

The announcement was made by the UAE's Ministry of Finance, following an amendment to the law concerning taxation of corporations and businesses.

Cabinet Decision No.10 of 2024 will come into effect on March 1.

The fine will be imposed on businesses that do not submit their registration applications within the timelines specified by the Federal Tax Authority.

The ministry said that the penalty was introduced to ensure compliance with tax laws. It also added that the amount is set in line with the late registration penalties imposed for excise tax and value added tax.

Ras Al Khaimah celebrates record-breaking tourism year in 2024

Ras Al Khaimah celebrates record-breaking tourism year in 2024

UAE and Japan to strengthen space industry cooperation

UAE and Japan to strengthen space industry cooperation

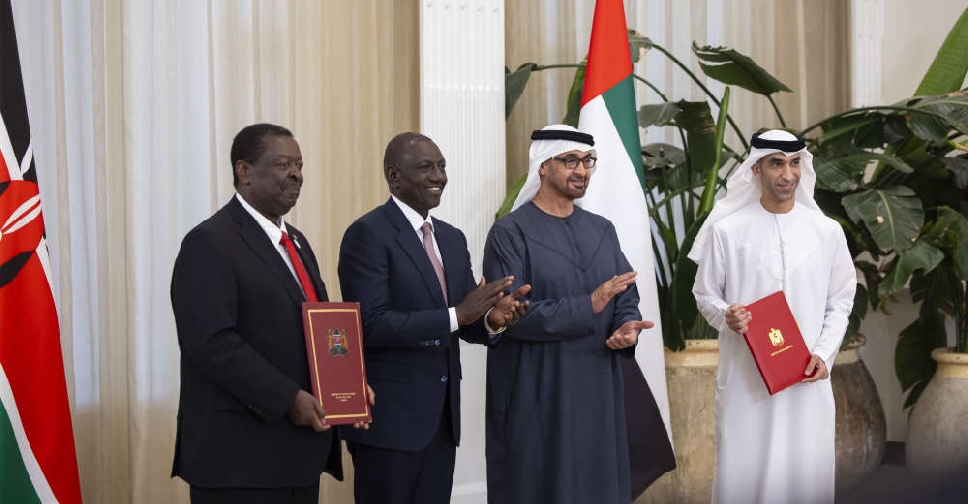

UAE and Kenya sign CEPA deal in Abu Dhabi

UAE and Kenya sign CEPA deal in Abu Dhabi

UAE, Malaysia confirm CEPA to deepen trade, investment ties

UAE, Malaysia confirm CEPA to deepen trade, investment ties

UAE, New Zealand CEPA formally signed

UAE, New Zealand CEPA formally signed