Bitcoin popped back above $50,000 in Asian trade on Thursday, clawing back some of the 17 per cent plunge that followed Elon Musk's tweet that Tesla would stop accepting the digital tokens as payment for its cars.

The price of the world's largest cryptocurrency dropped from around $54,819 to $45,700, its lowest since March 1, in just under two hours following the tweet shortly after 2200 GMT. It recovered about half of that drop early in the Asian session, and last traded about $51,099.

Ether, the world's second-largest cryptocurrency, followed a similar pattern, dropping 14 per cent to touch a low of $3,550, before bouncing back above $4,000.

"We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel," Musk wrote.

Tesla's announcement on February 8 that it had bought $1.5 billion of bitcoin and that it would accept it as payment for cars has been one factor behind the digital token's surging price this year.

As a result, Musk's comments roiled markets even though he said Tesla would not sell any bitcoin and would resume accepting the cryptocurrency as soon as mining transitioned to more sustainable energy.

The digital currency is still 30% higher than before Tesla's February announcement.

At current rates, bitcoin mining devours about the same amount of energy annually as the Netherlands did in 2019, data from the University of Cambridge and the International Energy Agency showed.

"The issue (of huge energy use by bitcoin miners) has been long known so it's nothing new, but taken together with Musk's recent comments about dogecoin, his latest comments seems to suggest his passion for cryptocurrencies may be waning," said Makoto Sakuma, researcher at NLI Research Institute in Tokyo.

Cryptocurrency dogecoin lost more than a third of its price on Sunday after Musk, whose tweets had stoked demand for the token earlier this year, called it a "hustle" on the "Saturday Night Live" comedy show. On Tuesday, however, he was asking his followers on Twitter if they wanted Tesla to accept dogecoin.

A broader selling of risk assets in traditional markets was another factor in the plunge, said Jeffrey Wang, Vancouver-based head of Americas at Amber Group, a cryptocurrency service provider.

"I don’t think everything is selling off just because of this news. This was kind of the straw that broke the camel’s back in terms of adding to the risk sell-off," he said.

On Wednesday, the S&P 500 dropped 2.1 per cent, and the Nasdaq Composite lost 2.7 per cent.

Smaller cryptocurrencies were less affected by the news.

"Interestingly enough, altcoins are performing well," said Justin d'Anethan, sales manager at Hong Kong-based head of exchange sales at Diginex, a digital asset company.

"The reason given in the tweet is fossil fuel use for the mining of BTC, but most cryptocurrencies have already found more efficient ways to do that and therefore outperformed."

Bitcoin has struggled since hitting a record $64,895.22 in mid-April, dropping to the cusp of $47,000 just 11 days later before hovering around $58,000 since the start of May.

By contrast, ether soared to a record $4,180.12 on Wednesday, and, even with the current pullback, is up 435% in 2021, eclipsing bitcoin's 75% rise. Its popularity stems in part from the ethereum network's growing number of uses, including non-fungible tokens, which are used to certify unique ownership of things like online artwork.

The bitcoin dominance index, a ratio of bitcoin’s share of the total market cap of all cryptocurrencies, dropped to 42%, its lowest since June 2018.

"The trade we’ve been pushing for a while now is short bitcoin, long ether, and that trade has been a thing of beauty," said Chris Weston, head of research at broker Pepperstone in Melbourne.

"The question everyone is asking is at what stage will ether have a bigger market cap than bitcoin, and I think that day will come personally."

Ras Al Khaimah celebrates record-breaking tourism year in 2024

Ras Al Khaimah celebrates record-breaking tourism year in 2024

UAE and Japan to strengthen space industry cooperation

UAE and Japan to strengthen space industry cooperation

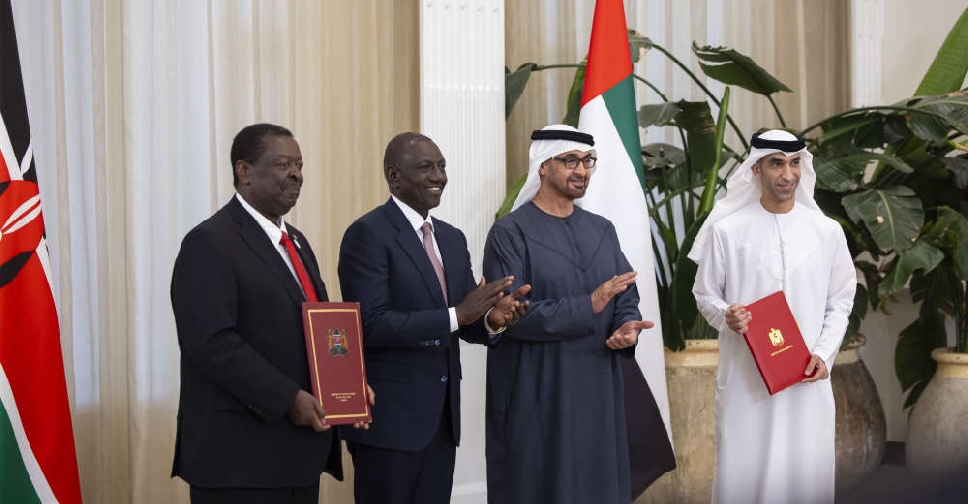

UAE and Kenya sign CEPA deal in Abu Dhabi

UAE and Kenya sign CEPA deal in Abu Dhabi

UAE, Malaysia confirm CEPA to deepen trade, investment ties

UAE, Malaysia confirm CEPA to deepen trade, investment ties

UAE, New Zealand CEPA formally signed

UAE, New Zealand CEPA formally signed