Salary increases in the UAE are expected to average 3.6 per cent this year, which is marginally down from the last two years.

That's according to the consulting firm Mercer's Total Remuneration Survey (TRS), which also predicts only 5 per cent of companies to freeze salaries in 2022, as compared to 10 per cent this year.

The study found businesses are keen to hire more people on the back of positive economic sentiments but says they will need to readdress their compensation and benefits strategies to attract and retain top talent.

For 2022, industries that will be aligned to the 4 per cent salary increase include high-tech, life science, and consumer goods.

Conversely, energy salary increases are expected to be slightly lower at 3.8 per cent.

Mercer polled 599 UAE companies across a range of sectors, including manufacturing, retail and wholesale, high tech, chemicals, consumer goods, life sciences and energy.

"This year’s Total Remuneration Survey shows positive sentiment toward hiring trends and salary increases although not quite at pre-pandemic levels. Companies must focus on continuing to provide flexible working models to employees in order maintain a strong proposition as an employer," said TED Raffoul, Mercer's Career Products Leader, MENA.

"To attract and retain top talent employers must look to maintain pace with market-wide salary growth and benefits. Optimism is strong when looking at 2022 with many UAE companies forecasting a higher wage increase in order to attract and retain top talent, particularly in competitive fields," added Andrew El Zein, Associate, Career, MENA at Mercer.

UAE, Montenegro to develop renewable projects under new partnership

UAE, Montenegro to develop renewable projects under new partnership

UAE joins US-led Pax Silica initiative to bolster technology supply chain

UAE joins US-led Pax Silica initiative to bolster technology supply chain

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

Netflix prepares all-cash offer for Warner Bros, source says

Netflix prepares all-cash offer for Warner Bros, source says

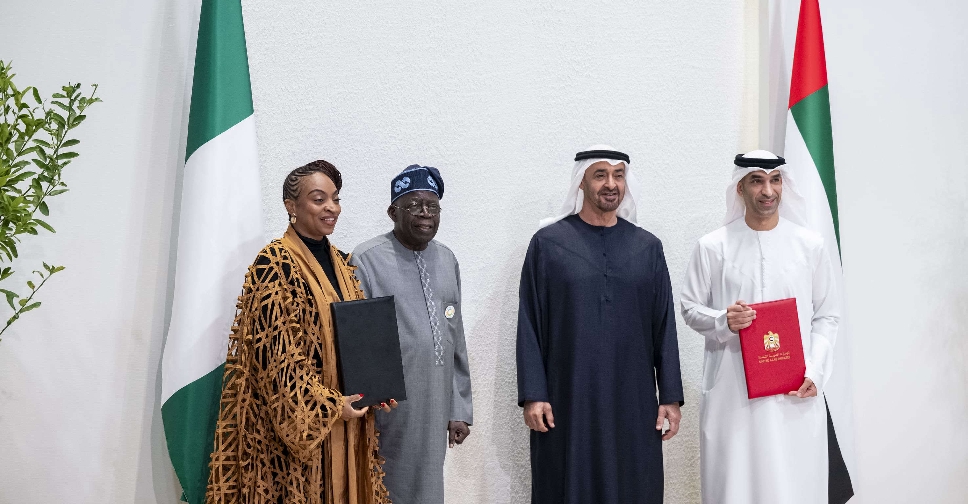

UAE, Nigeria sign comprehensive economic partnership agreement

UAE, Nigeria sign comprehensive economic partnership agreement